Understanding Charity Metrics

How can general charity metrics be used to help inform your decision on which charity to support? This is the first article in a series that will help assess the accountability of a charity, what their reported financial information could mean and how it relates to their mission.

Most of the information about a charity is provided in Annual Information Statements (AIS). These documents are the main source of communication from charities to the Australia Charities and Not-for-profits Commission (ACNC). All registered charities have to submit AIS statements, unless they meet specific requirements.

Giving Guide utilises this information to provide donors a broad overview of the charity and presents the information in an alternate way. Charity metrics range in complexity and currently no common baseline exists for comparing one charity to another. For instance, two similar charities aiding the same beneficiary may go about their mission in different ways.

Key Information

Firstly, let’s review the information and charity metrics provided by Giving Guide.

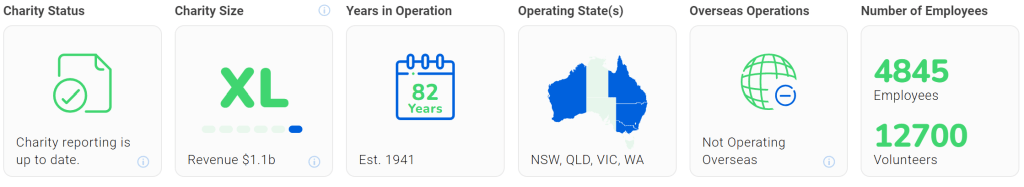

- Charity Status: Attests that the charity meets the minimum governance standards set out by the ACNC. It also indicates the charity has complied with reporting and provision of information. There are three possible tiles for any given charity: Green = Charity Registration is up to date; Orange = Reporting is late; and Red = charity has enforcement action or registration is temporarily, voluntarily or permanently revoked. We would advise sticking to the Green tiles, not excluding the Orange tiles for late reporting, but proceed with caution on any red tiles.

- Charity Size: Size is based on the amount of the charity’s annual revenue. For more information read our article on big vs small charities. Giving Guide uses more size categories than the ACNC: Extra Small (<$50k); Small ($50k-$250k); Medium ($250k-$1m); Large ($1m-$10m); Very Large ($10m-$100m); and Extra Large (>$100m).

- Years in Operation: This tile shows the year the charity was established and number of years in operation. You may wish to support an established charity or help a newly created charity.

- Operating State(s): This tile shows the state(s) where the charity operates and/or is based in Australia. Some charities may select one state as their base of operations, but serve and operate in a combination of states.

- Overseas Operations: Some charities operate outside of Australia. However, they must have a physical address in Australia to be registered. The countries where the charity operates are listed below the second set of tiles.

- Number of Employees: This tile shows the number of paid employees in terms of Full-Time Equivalent (FTE) staff and the number of volunteers. n.b. the Employees section for more information.

Headline Data

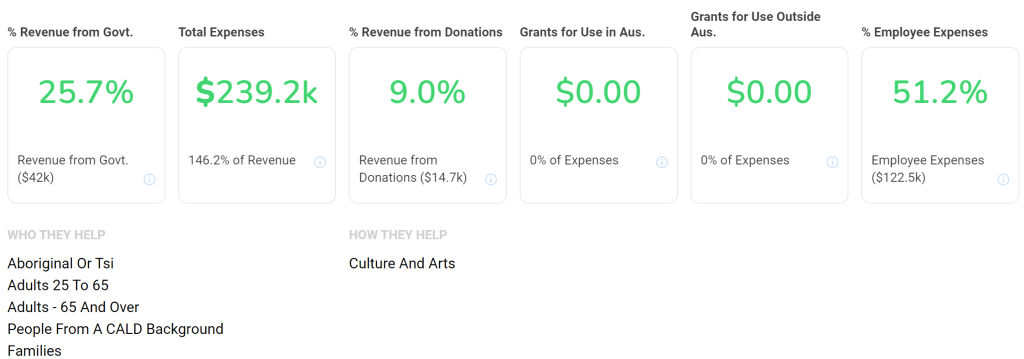

The second half of the Key Information offers some financial statistics about the charity:

- % Revenue from Government: Provides the amount of revenue from government and the proportion in relation to total revenue, which includes funding from grants, contracts, rebates and subsidies provided by Commonwealth, State, Territory or local governments.

- Total Expenses: Shows all operating expenses over the year and the percentage of the charity’s revenue this represents. Categories include expenses from paying employees, interest payments, administration costs and “other” expenses.

- % Revenue from Donations: Indicates the percentage of revenue received from donations (including fundraising, trusts, non-government grants, member/supporter/employee donations and bequests) and the charity’s total revenue from these sources.

- Grants for Use in Australia: Information includes the amount provided and its’ percentage of the charity’s total expenses (charities can make grants to other charities, individuals or beneficiaries, while some provide scholarships).

- Grants for Use Outside Australia: This category may include sponsorship programs or projects, donations (including goods and services) to sister organisations or governing bodies either by directly sending money overseas or indirectly through other Australian organisations or charities. Charities must report which country received a grant or donation. If an organisation has provided support to a particular country, it will be listed under “Overseas Operations”.

- % Employee Expenses: Shows the percentage of revenue allocated to employee expenses in relation to the charity’s total expenses.

The final items in the Key Information section are “Who They Help” (i.e., the charity’s main recipients), “How They Help” (i.e., the charity’s main mission(s)) and “Overseas Operations” (i.e. other countries of their beneficiaries). The activities that charities choose to describe their mission are based on the International Classification of Non-profit organisations. All charities must select a main beneficiary (i.e., who they help) but other beneficiaries may also be listed.

Other Sections

Further details are provided about the charity. The information is divided into sections: Key information; Basic information; Financial data; People; Programs and Reports. If a section or sections are missing the charity either has yet to submit any information, is not required to provide this information or has requested their information is not shared publicly.

Basic Information Section

The Basic Information section provides further detail about the structure and purpose of the charity, including the charity’s Australian Business Number (ABN), their contact information and purpose statement. This is where they explain their mission and the support they have been providing to the community. Some of the more technical information includes:

- Entity Type and Incorporation Type: Charities must make sure their governing documents are in line with their legal structure. Legal structures may be incorporated (i.e., incorporated associations, companies limited by guarantee, non-trading co-operatives, indigenous corporations) or unincorporated (i.e., trusts, unincorporated associations).

- Tax Concession Status: Tells you whether the charity has been endorsed by the ATO (including the date) for one or more of the following tax concessions: exempt from income tax, eligible for GST concessions or qualified to receive fringe benefit tax rebates or exemptions, up to a certain capping threshold.

- DGR Status: Shows whether the charity has Deductible Gift Recipient (DGR) status: Item 1, 2 or 4. Item 1 refers you to lists of funds, authorities and institutions such as public hospitals, overseas aid funds and public museums (including entities listed by name). While Item 2 DGRs are called ancillary funds and describes funds set up solely for: providing money, property or benefits for deductible gift recipient (DGR) covered by item 1, or the establishment of such DGRs. Item 4 DGRs describes Funds, Authorities or Institutions that may receive donations of property under the cultural gifts program.

- Fundraising: Provides the fundraising licence number(s) for States that require the charity to register to fund raise in that State. Depending on the amount of funds raised in a particular State a licence may not be required.

Finances & Employees

Following on from the Basic Information section we find the Financial Data and People sections, including:

- Revenue vs Expenses Graph: Displays the total revenue and expenses for each year since 2013.

- Revenue and Expenses Breakdown: Shows you the percentage and the amount from various sources of revenue/expenses and the total revenue/expenses from the previous reporting year. You can also see the current net surplus or deficit of the charity.

- Assets and Liabilities Breakdown: Like above, giving you net assets/liabilities.

- Breakdown of Employee Structure Graph: Presents the number of full time/part time/casual employees and volunteers for each year since 2013.

- Staff Costs: This differs from the employee expenses metric as it gives employee costs as a percentage of revenue, rather than as a percentage of expenses.

- Full Time Equivalent Employees: A charity’s full-time equivalent (FTE) staff figure refers to the number of full-time employees it would have if it combined the hours of all full-time, part-time and casual employees.

- Average Expense per Employee: Takes the total amount of revenue spent on employees and divides it by the number of full-time equivalent employees. While employees will usually be paid differently depending on their role, this gives you a rough measure of the average employee cost for the charity.

- Full-Time, Part-Time and Casual Employees: Gives both the number of people in each category and percentage of all employees. The number of volunteers is also provided below.

The People section also lists the name and title of up to 16 Responsible People who make up the governing body, board or committee responsible for the governance of a charity. This covers 99% of all charities. Some have boards consisting of 97 responsible people, while the average is approximately 7.

Programs

The Programs section describes most of the specifics surrounding a charity’s activities. Started by the ACNC in 2020, the programs section was designed to describe the method by which a charity provides for its’ beneficiaries. Programs are reported yearly, and each program must have a name, broad classification and at least one beneficiary. Charities may optionally specify the domestic or overseas location(s) of the program’s operation and additionally, a specific website for the program.

Reports & Documents

The Reports and Documents section is where you can download and read a charity’s governing documents, financial reports, annual reports (which give more information about a charity’s work as well as its finances) and annual information statements (which must be provided to the ACNC). This is where you can get a feel for the detail of the charity and the effort put into their documents. Small charities (<$250K) are not required to provide financial reports however they can be provided. Only medium (>$250k to $1m) or large (>$1m) charities must provide financial reports. A medium sized charity must provide a signed and dated reviewer’s report or auditor’s report and a large charity is required to submit a signed and dated auditor’s report.

Conclusion

Charities registered by the ACNC have agreed to the Governance Standards imposed. However, being registered and receiving the ACNC charity tick is not evidence proving the charity is efficiently run and effective. It is up to the donor to investigate a charity’s metrics thoroughly and determine if they meet their standards.

The regulation of charities in Australia is focused mainly on financial information. Please look at our article on “The Overhead Myth” to explain some of the intricacies, or “Australian Charity Regulation” if understanding charity legislation and reporting is your goal. Significant headway is being made amongst academics to understand and measure the impact charities are having in their communities. Our Search by Location feature specifically helps donors find charities in their local community.

We will continue to explain the information available on charity metrics that we provide. Keep a look out for the next article.

Discover, Learn, Give.

Guide

Share

About Us

Integrity, honesty and unbiased assessment are at the core of Giving Guide’s mission. The charity sector is important to the economy and culture of Australia, We believe independently assessing the accountability, transparency and effectiveness of the sector beyond what is currently available is important to it's future.

Giving Guide anticipates enhancing the level of governance and transparency in the Australian charity sector. An independent charity advisor would benefit the sector by helping charities consider exceeding the existing governance standards of the Australian Charities and Not-for-profits Commission (ACNC) to the benefit of donors.

More Articles

Let's change charity

Please get in touch and let us know your thoughts on how we can improve the charity sector in Australia.